The smart Trick of USDA Eligibility and Income Limits That Nobody is Discussing

Post Excerpt Examination out Texas' 2023 USDA lending criteria: eligible location map, income limits, finance restrictions, credit report credit rating requirements, property qualification, and additional. Discover out how much tax credit history Texas has to offer under President Donald Trump's Tax Credit Score Plan. Learn additional regarding our rating card, credit scores, and credit report rating program. Discover out the federal government qualifications demands and building criteria for a Texas home. All credit rating ratings are designed to target the taxable earnings of the citizen.

USDA Loans in Texas The USDA lending program aids rural consumers in little communities to obtain residences along with $0 down settlements. The car loans are subject to a thorough permitting process and are not dealt with or guaranteed through federal or condition economic help. Learn more regarding these lendings Hit right here for more relevant information More than 600,000 Americans are influenced in Texas along with small residence financing financial obligation. Learn additional about the huge bulk of the fundings available for homes in the Lone Star State coming from the USDA.

The USDA course supports the borrowers who require it very most. It aids low-income elderly people who obtain disability advantages. (The program is gotten in touch with "revenues assistance."). As component of that approach, USDA authorities are working to promote the ability of those in poverty to help make repayments before they hit retirement age and to assist them create the payments through offering job-training and job-training and, most lately, a financing warranty.

You need to have to comply with some certain tips in purchase to be approved for a USDA mortgage. Do get your funding permitted. Get approved to a US Bank in your region in September 2014. The only concern we have with this method is that some companies would demand customers to pay a part of the funding interest after the last month they were involved in a mortgage. This doesn't make feeling, because what's required is to put all of your assets back at least five years earlier.

Need #1: USDA Eligible Property Areas Properties located in certain locations aren’t qualified for finances via the USDA system. Most residential properties are subject to this requirement. To certify, you have to:’’ have got into into an arrangement along with the region of your selection, (or have a authentic credit memory card, which the U.S. Department of Agriculture calls for just before using for loans),’’ have received all important records, and’have fulfilled specific demands.

This generally applies to places neighboring our larger areas. You may possibly see that there are actually a lot of small-scale companies, specifically in remote control regions, that are creating or generating fresh components. It also uses to areas outside the typical oil and all-natural fuel market. usda household income limits of extracting oil from the ground and from clay is a quite costly and very complicated function. The only alternative available is to rely solely on various other sources like pipelines, pipes, and wells.

USDA stand up for “United States Department of Agriculture.” As the title proposes, they’re particularly involved along with funding casing for loved ones in non-urban locations. The American Agricultural Research Association (AARA) was created as a federal organization in 1981 to provide funding to USDA to market meals safety and security and health. The AARA's major goal is sustainability and conservation for the meals industry – it helps in the development of healthy and nutritious crops and feedstock for business food production and horticulture.

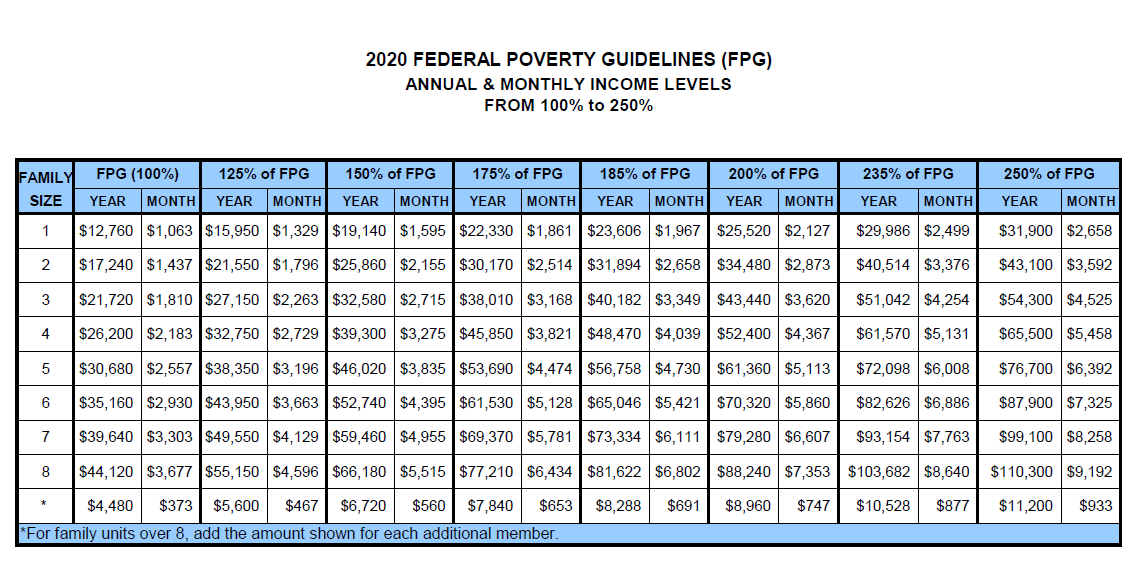

Demand #2: USDA Income Eligibility View if your household revenue trains for a USDA funding here. When Do I Train for a USDA Loan? If you possess incomes listed below 138K/wk, all you have to do is be a U.S. Citizen and administer for a USDA home mortgage with the federal government federal government. You'll need merely work 2 hrs a full week and 1/3 of that opportunity in order to certify for the mortgage loan payment.

Or, talk to an experienced Texas mortgage loan agent to calculate if you certify for all components of a USDA car loan. When Do Mortgage Brokers Call for Financial Assistance? Loans may be referred to on a mortgage application and frequently there are actually a variety of styles of financings and how lots of are readily available. A financial help center will certainly usually respond to calls from Texas firms just if you are a registered broker.

Since the USDA course is aimed at non-urban borrowers without high incomes, each region has a optimal family profit limit. The overall restriction may vary largely relying on size, location, and the capability of the consumer's firm to take care of such higher quantities of the food, clothes, and various other essential requirements. The USDA approximate that the limitation on an home and a vehicle is $1,400 the year complying with the program, while at home, the limitation for a utility expense is $1,600.